Condo Insurance in and around Bothell

Bothell! Look no further for condo insurance

Protect your condo the smart way

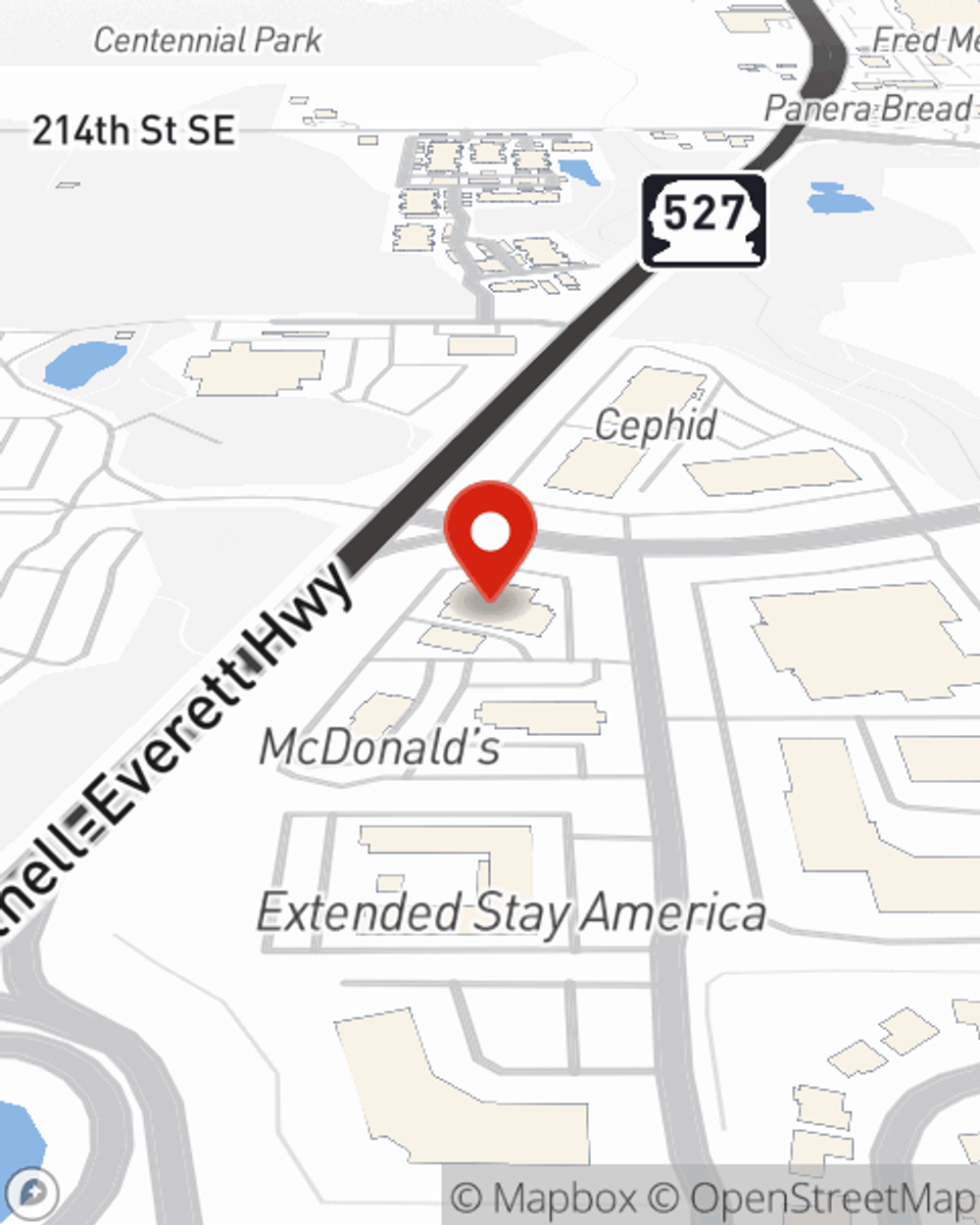

- Bothell

- Everett

- Monroe

- Lynnwood

- Kirkland

- Seattle

- Mill Creek

- Renton

- Bellevue

- Snohomish

- Mountlake Terrace

- Kenmore

- Lake Forest Park

- Brier

- Tacoma

- Clearview

Home Is Where Your Condo Is

When considering different liability amounts, providers, and coverage options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo unit but also your personal belongings within, including souvenirs, sound equipment, books, and more.

Bothell! Look no further for condo insurance

Protect your condo the smart way

Agent Rocio Luna Culotti, At Your Service

When vandalism, an ice storm or fire cause unexpected damage to your condo or someone gets hurt in your home, having the right coverage is vital. That's why State Farm offers such great condo unitowners insurance.

Intrigued? Agent Rocio Luna-Culotti can help walk you through your options so you can choose the right level of coverage. Simply stop by today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Rocio at (425) 318-4143 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Rocio Luna-Culotti

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.